Safe Harbor 401(k)

A streamlined 401(k) plan with simplified compliance and maximized contributions

A streamlined 401(k) plan with simplified compliance and maximized contributions

A flexible 401(k) plan with various employer contribution options

A streamlined, tax-advantaged plan designed for self-employed professionals.

A simplified, low-cost option for new plans--with no employer match

A retirement plan for schools, nonprofits, and certain public organizations

A state-sponsored retirement program for employees without a workplace plan

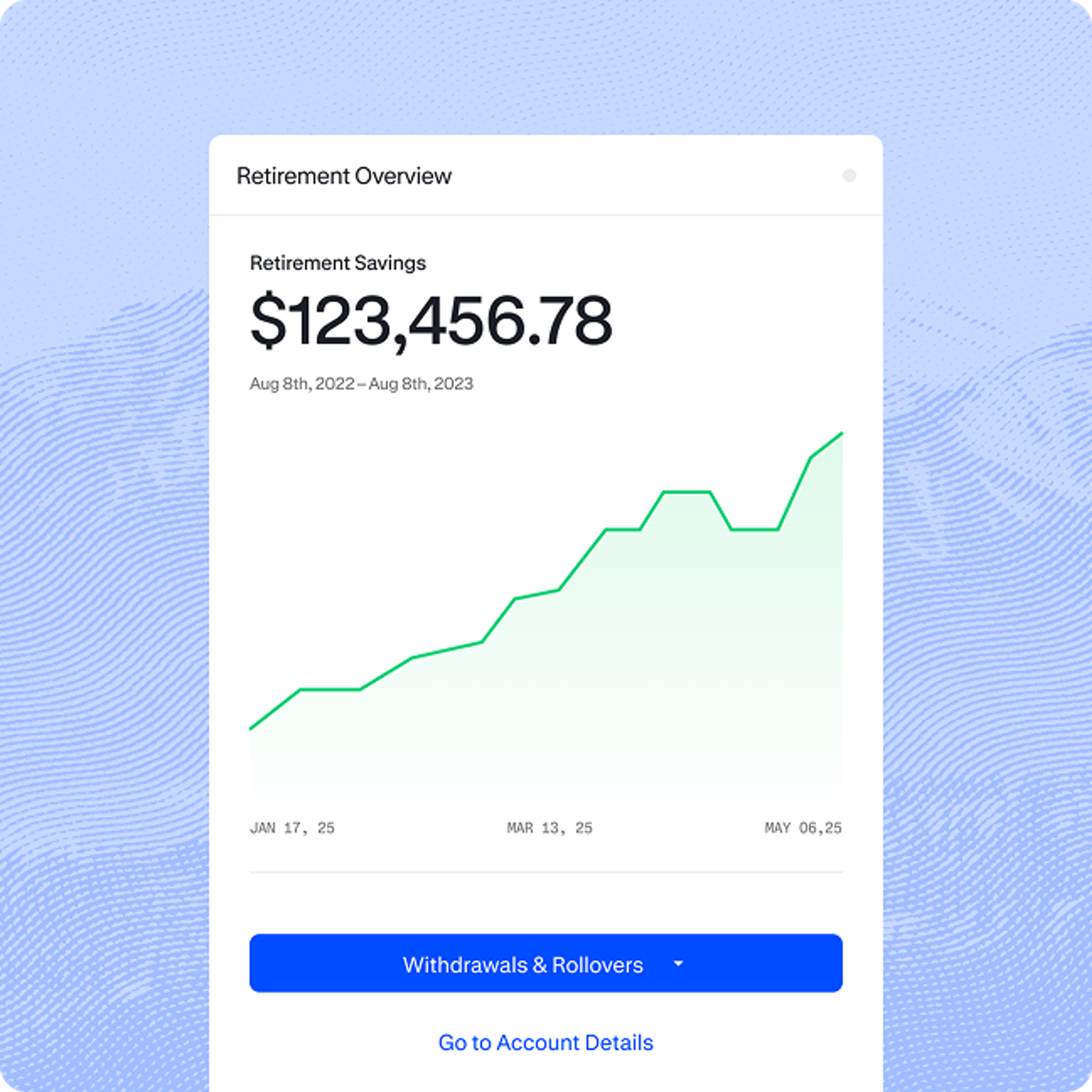

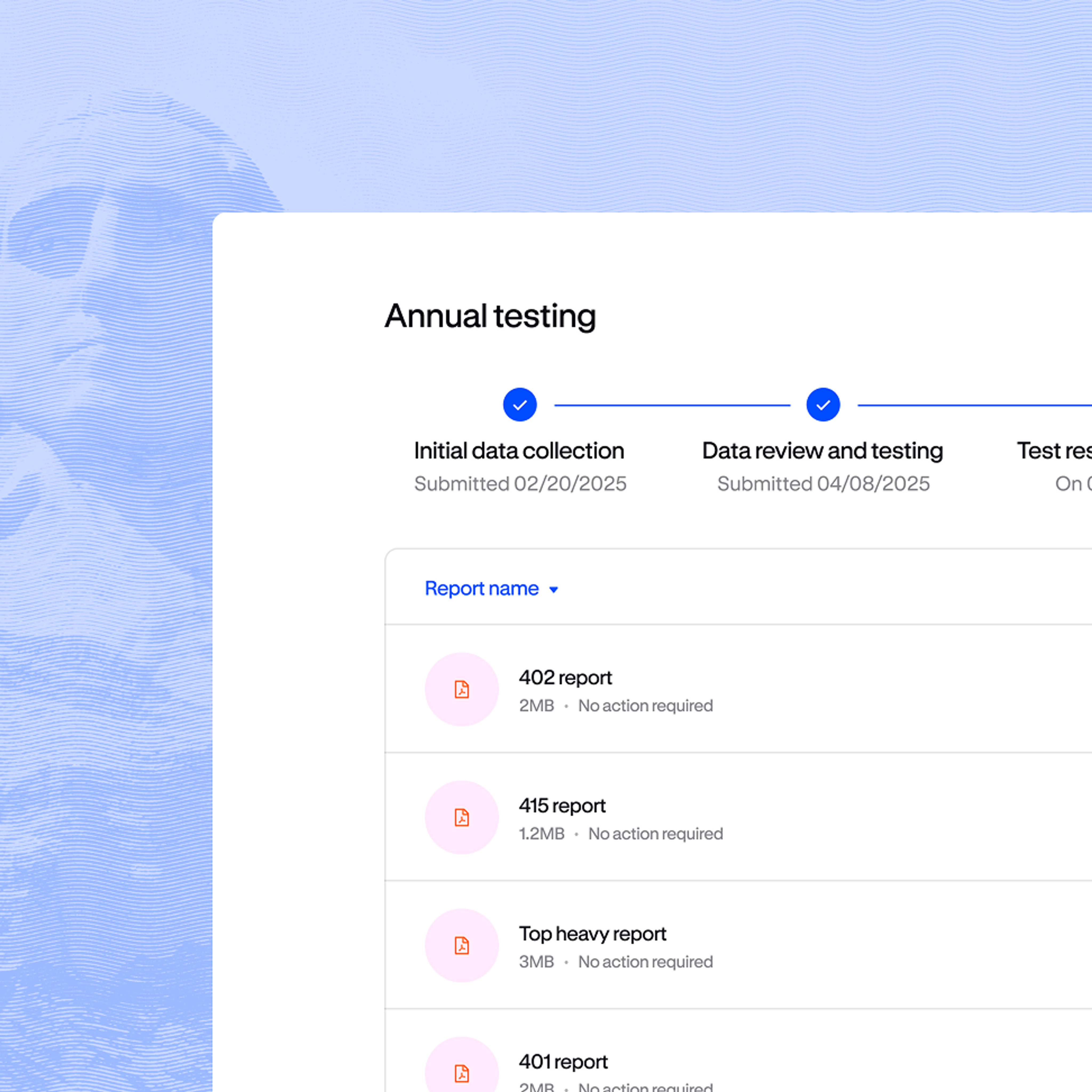

From automated payroll sync with 190+ providers to modern tech and tools, our platform lets you run your plan with ease.

Tailor your savings programs to your workforce, and as your needs change, our dynamic platform can evolve alongside you.

A dedicated service team offers industry expertise at every step with built-in compliance, administration, and 1:1 onboarding support.

Streamline plan setup and management with our modern platform, freeing you to deepen client relationships and expand your book of business.

Deliver more than retirement—from education and emergency savings to ABLE Disability Savings accounts—all from one unified platform that adapts to your clients’ needs.

Keep your brand front and center with co-branded portals, flexible investment options, and integrated compliance support designed for advisors.

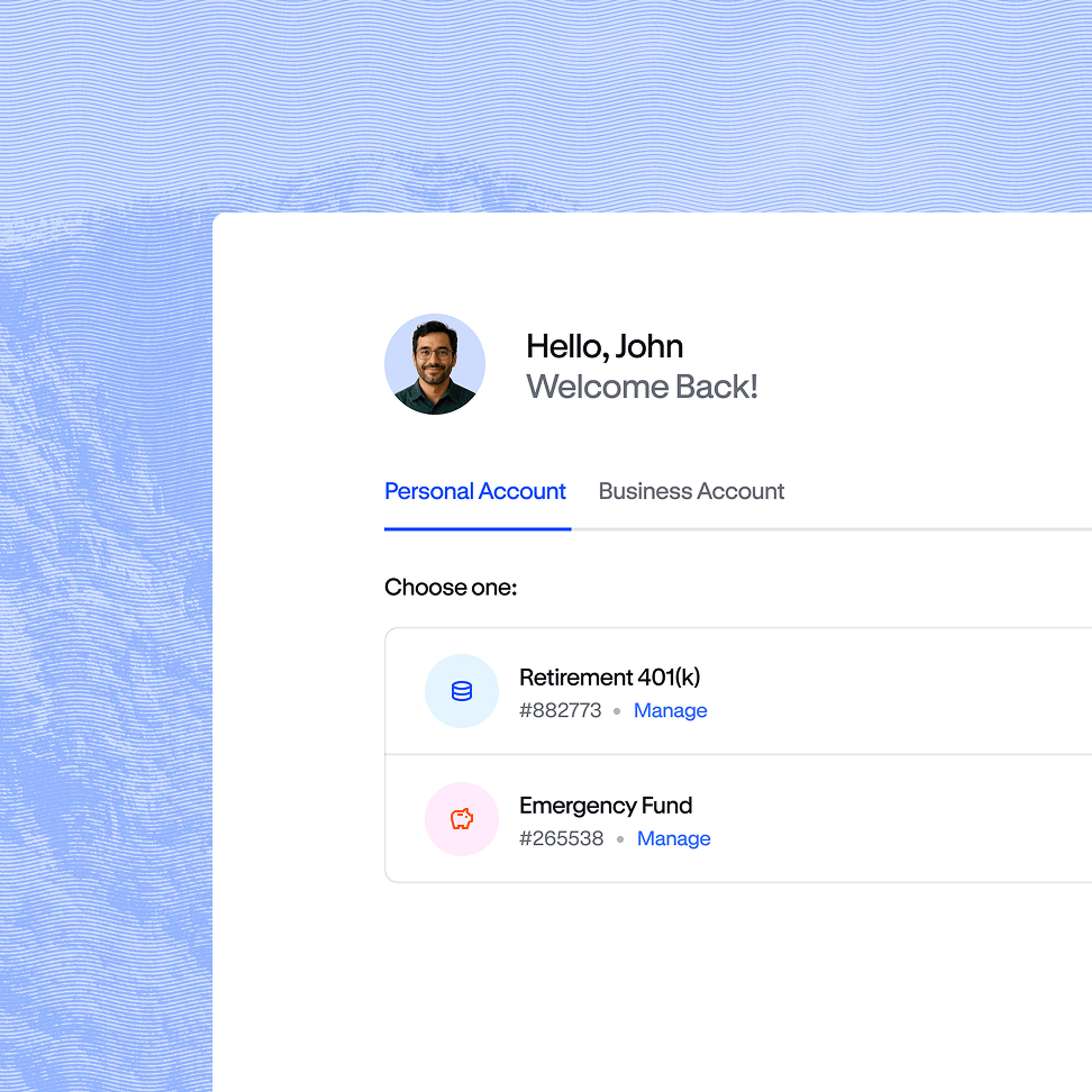

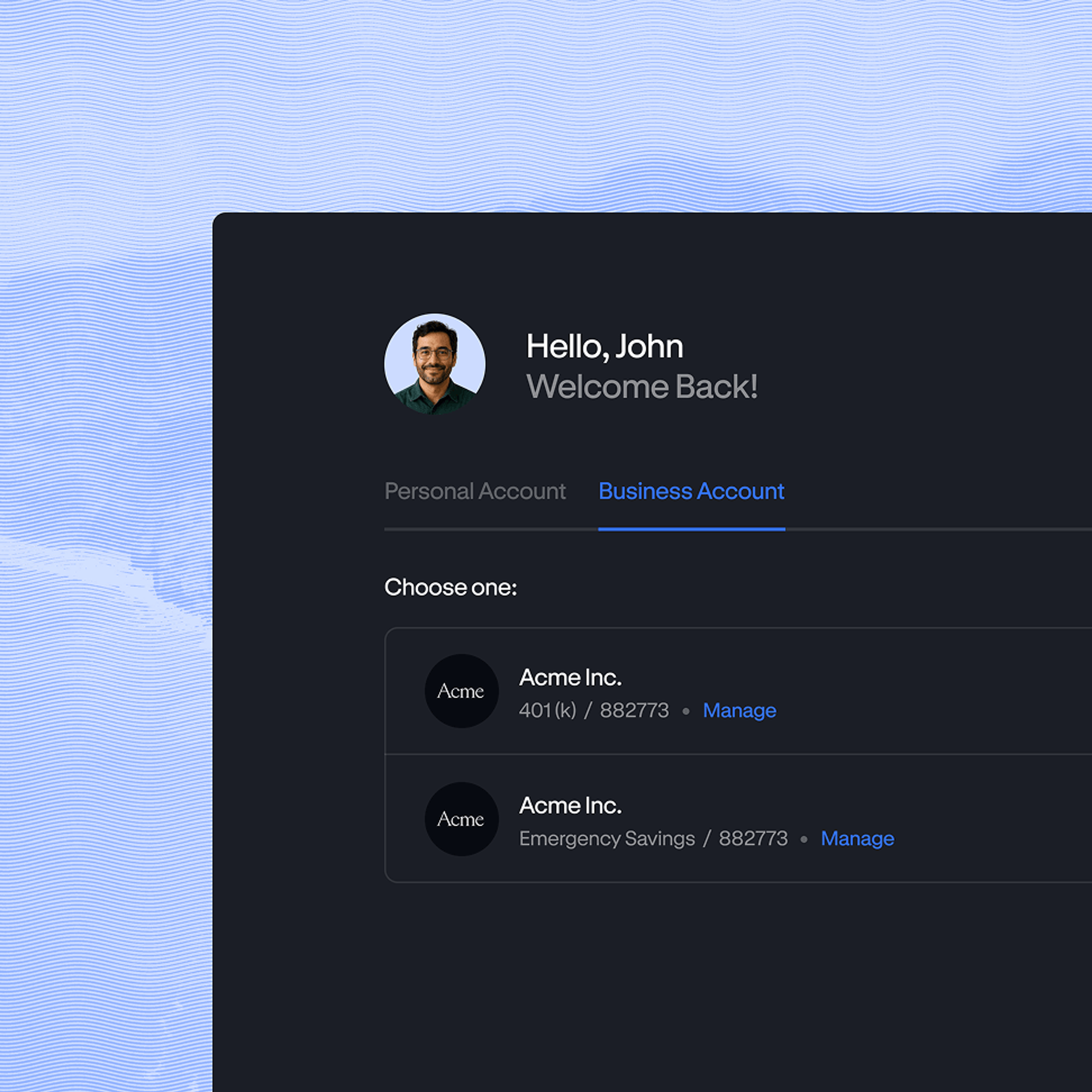

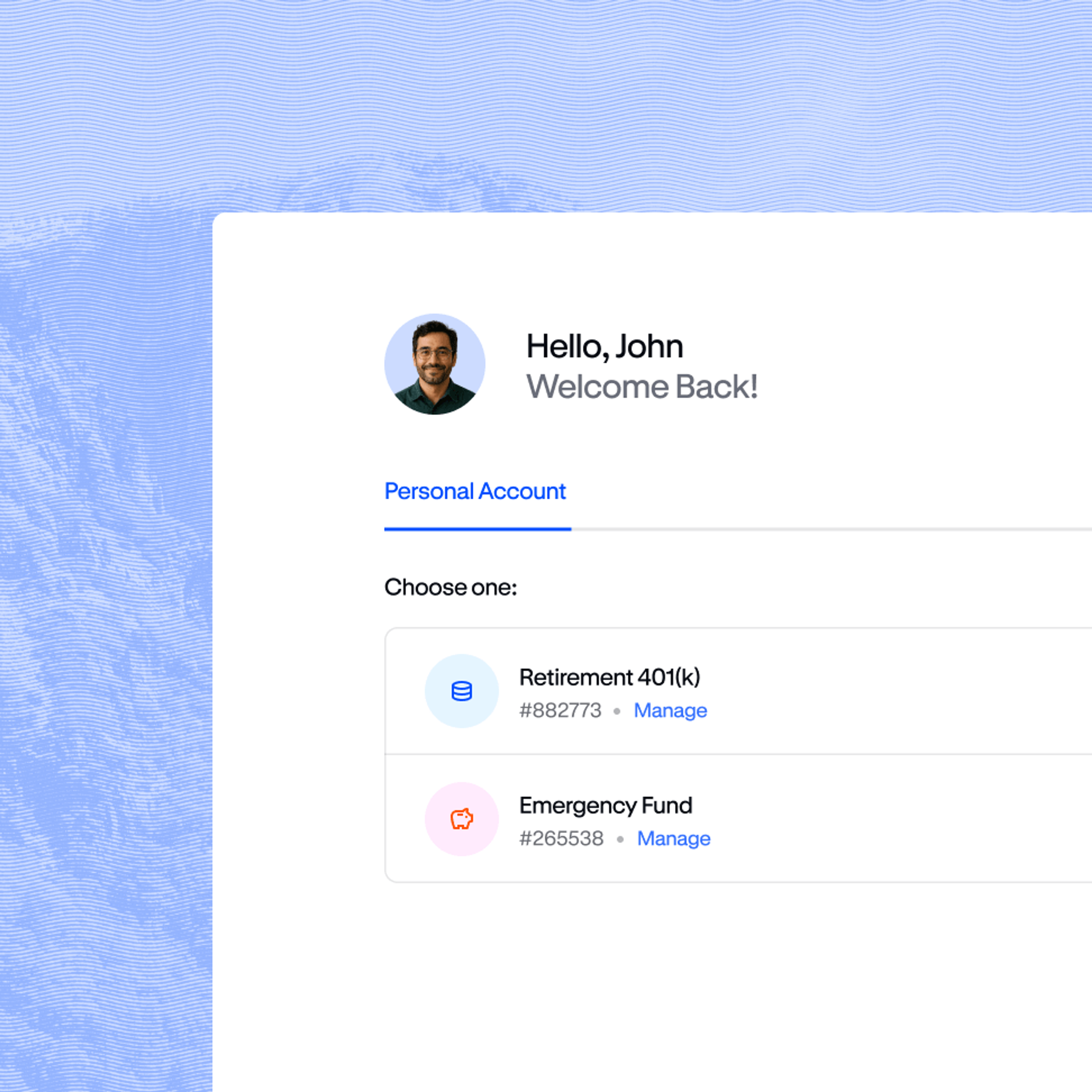

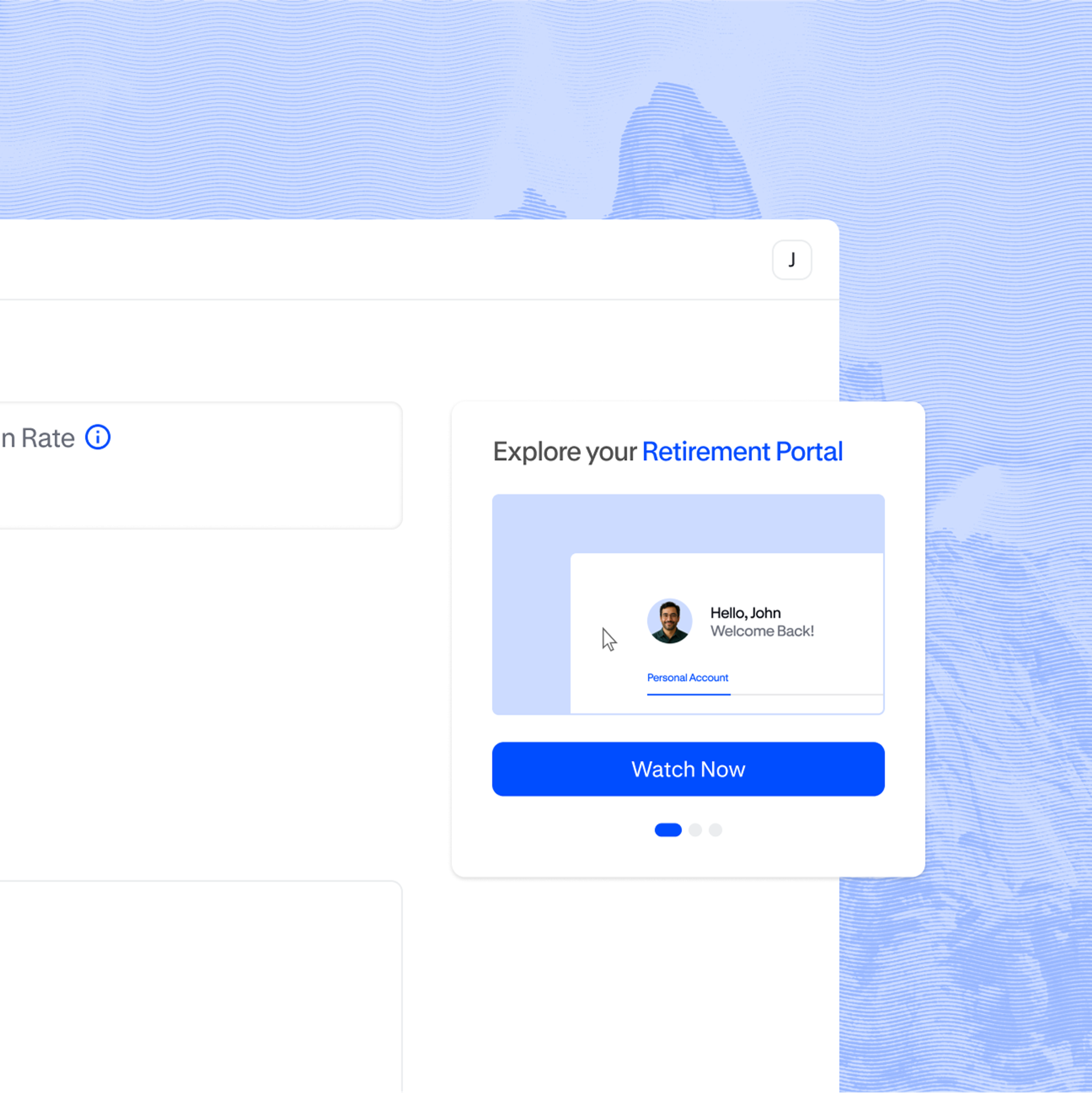

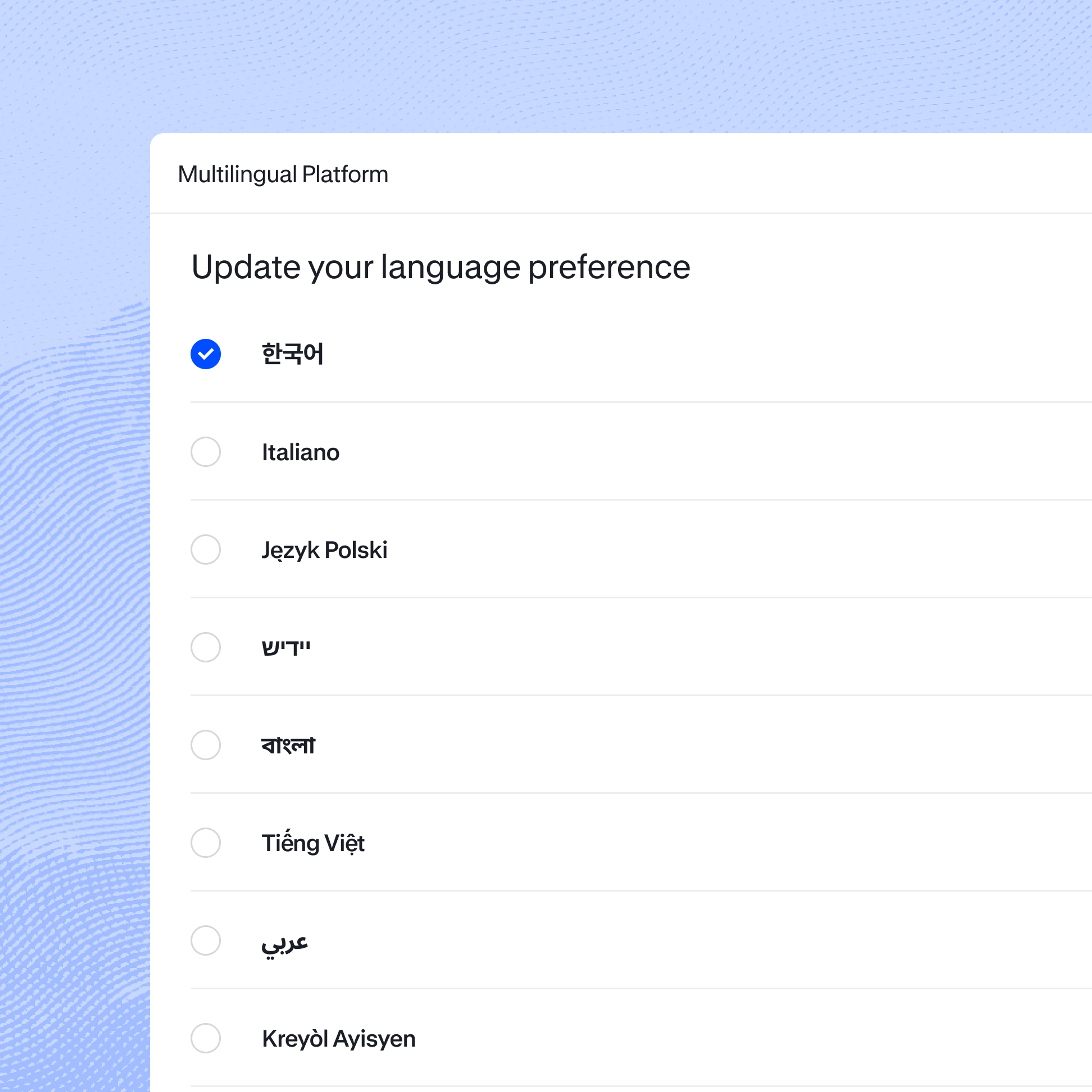

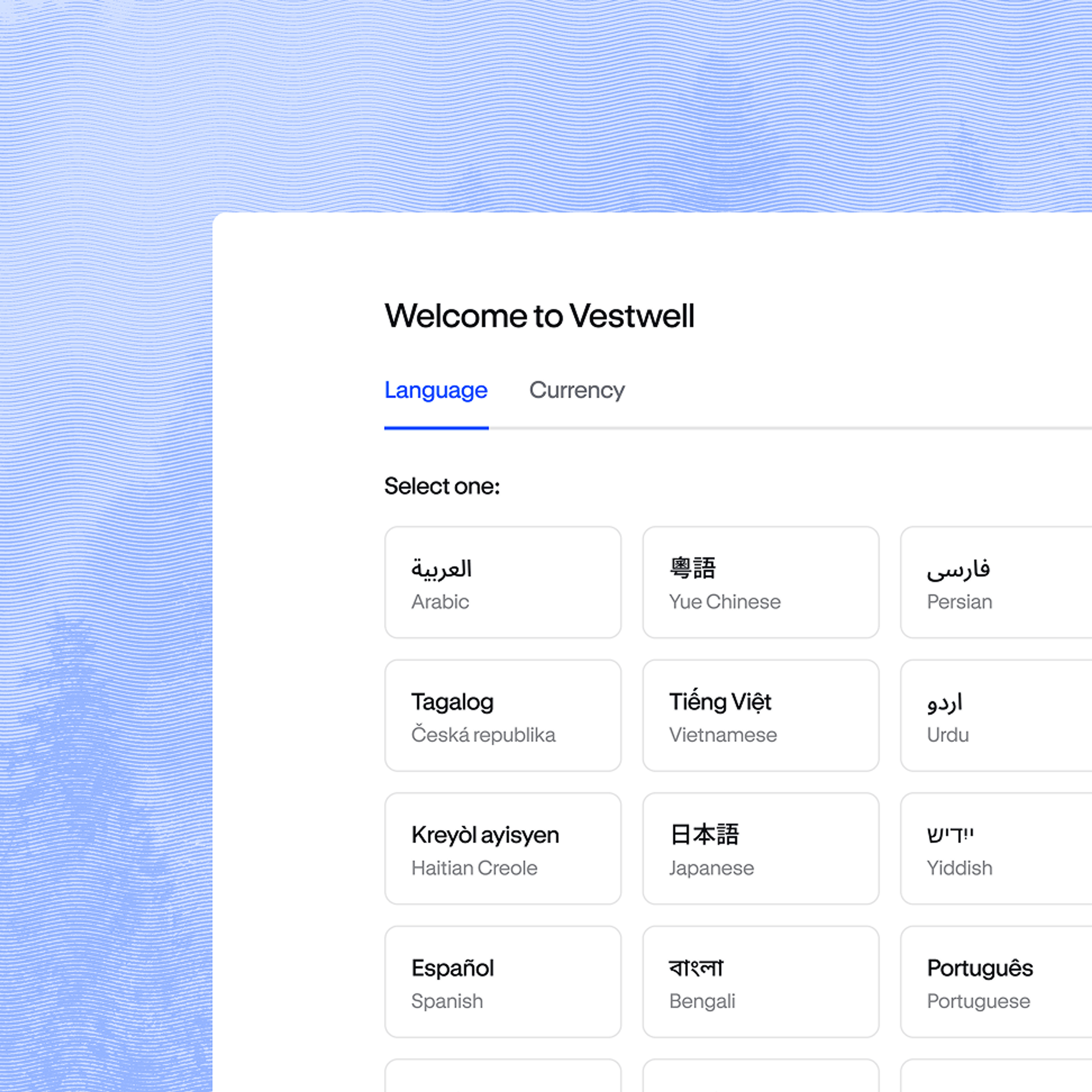

Manage retirement, education, emergency, and disability savings from one intuitive portal, accessible anytime, anywhere, in multiple languages.

Educational tools, behavioral nudges, and clear guidance empower you to make informed decisions and build lasting financial security.

Manage your retirement account in the language you prefer with support for 18 languages across both desktop and mobile.

Powering over 85% of government retirement savings programs, Vestwell is the proven, secure backbone governments rely on for large-scale savings initiatives.

Our multilingual, mobile-first platform expands access for underserved populations, supporting broader participation and financial equity.

From retirement mandates to ABLE Disability Savings and 529 programs, Vestwell combines robust compliance with modern technology to meet diverse policy needs.

Affordable plans for teams of any size.

Flexible plans for growing needs.

Custom benefits for complex orgs.

Empowering advisors with modern tools to deliver smarter savings strategies.

User-friendly, personalized savings experiences for every financial journey.

Partners in scaling public programs.

Robust, customizable benefits for modern organizations with growing complexity.

Robust, customizable benefits for modern organizations with growing complexity.

Simple, affordable retirement plans — whether you have 1 or 50 employees.

Flexible solutions for businesses with evolving needs.

“We wanted a retirement plan that set our company apart, and that's exactly what Vestwell has done for us.”

Whether you're rolling out your first plan or upgrading from a legacy provider, our team is ready to help.