Safe Harbor 401(k)

A streamlined 401(k) plan with simplified compliance and maximized contributions

Your business can Vestwell with integrated, full-service, and easy-to-manage workplace savings programs—built to evolve as you scale.

A streamlined 401(k) plan with simplified compliance and maximized contributions

A flexible 401(k) plan with various employer contribution options

A streamlined, tax-advantaged plan designed for self-employed professionals.

A simplified, low-cost option for new plans--with no employer match

A retirement plan for schools, nonprofits, and certain public organizations

A state-sponsored retirement program for employees without a workplace plan

Mid-sized businesses need flexible benefits built for their industry. Vestwell simplifies savings plan management, reduces admin work, and helps you offer benefits that attract and retain top talent.

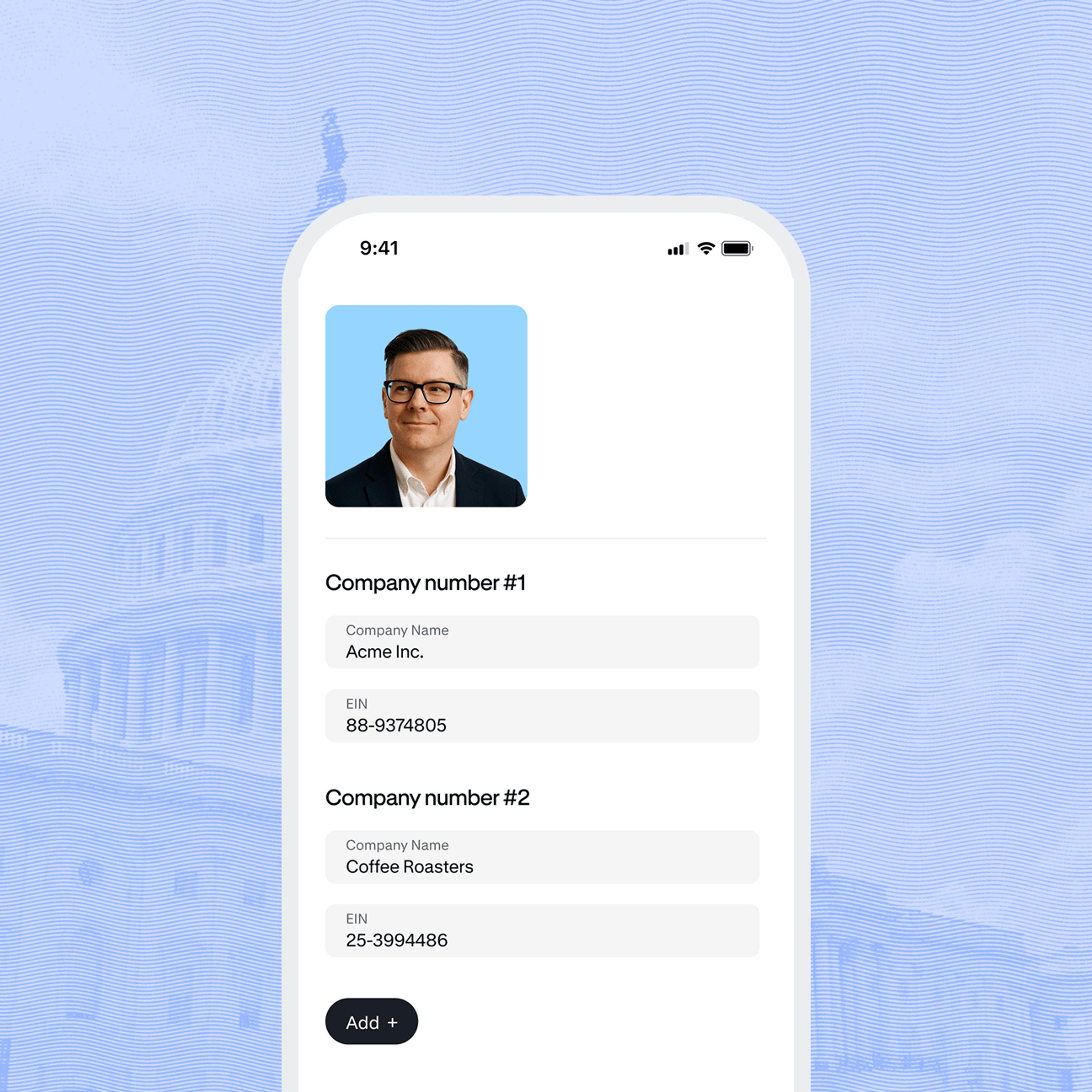

Manage complex org structures with ease. Vestwell supports multi-location and multi-EIN businesses through a centralized platform that adapts to how your company is organized.

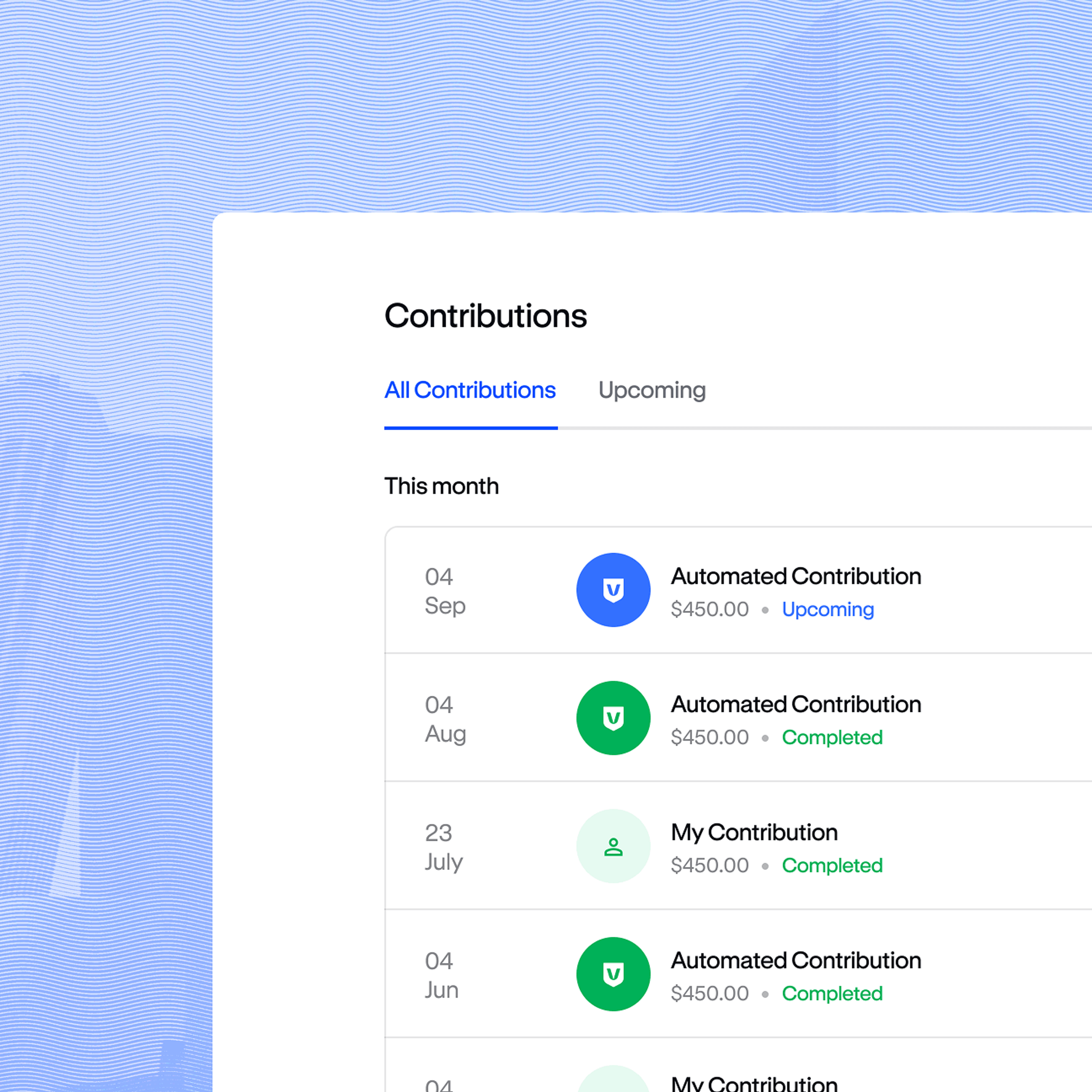

Automate contributions, eligibility tracking, and savings rate changes with deep integrations into 190+ leading payroll providers—reducing manual work and making plan management hands-off for your busy team.

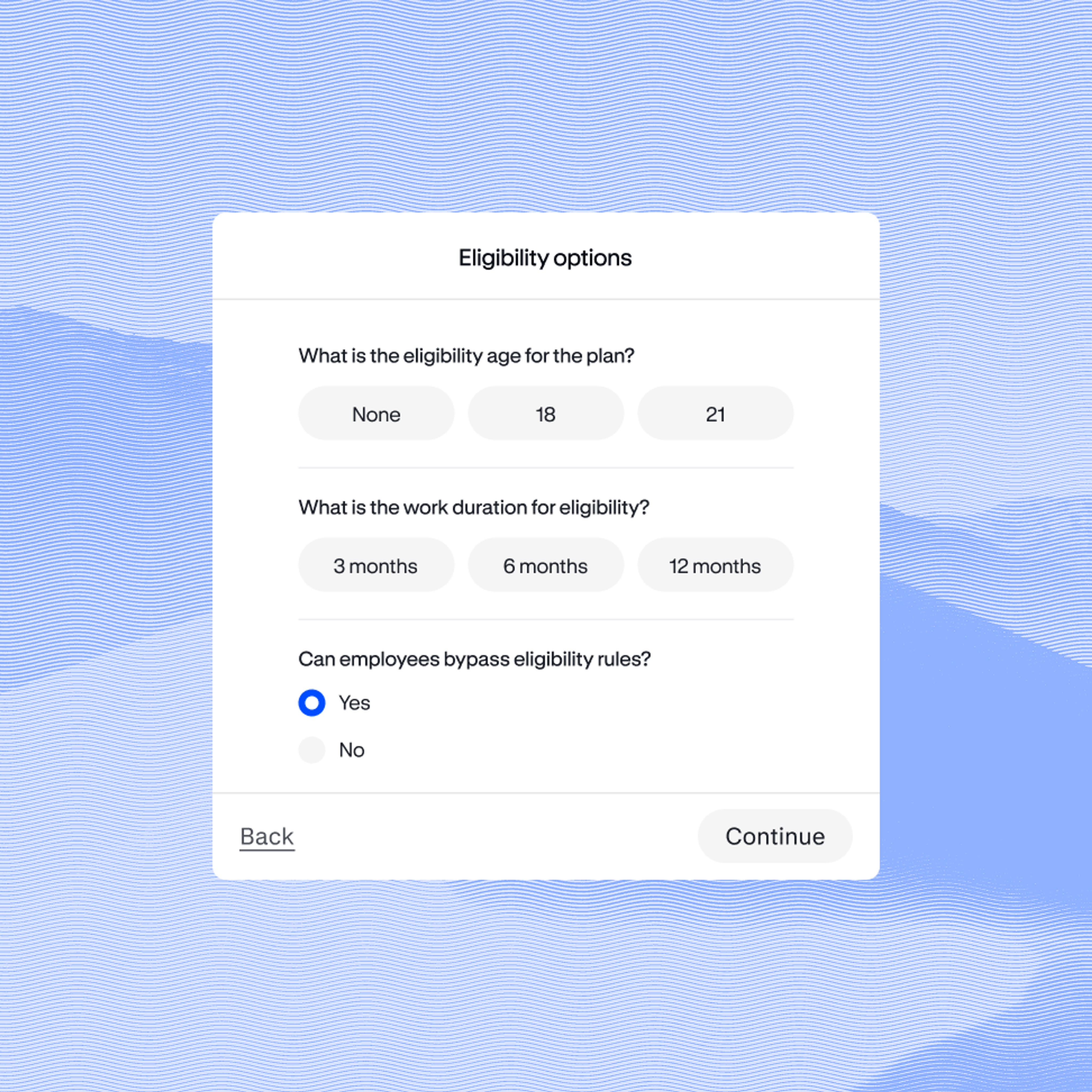

Whether you need unique eligibility rules, vesting schedules, contribution cycles, or match formulas, our customizable platform support program design across your benefits that reflect your company goals and employee needs.

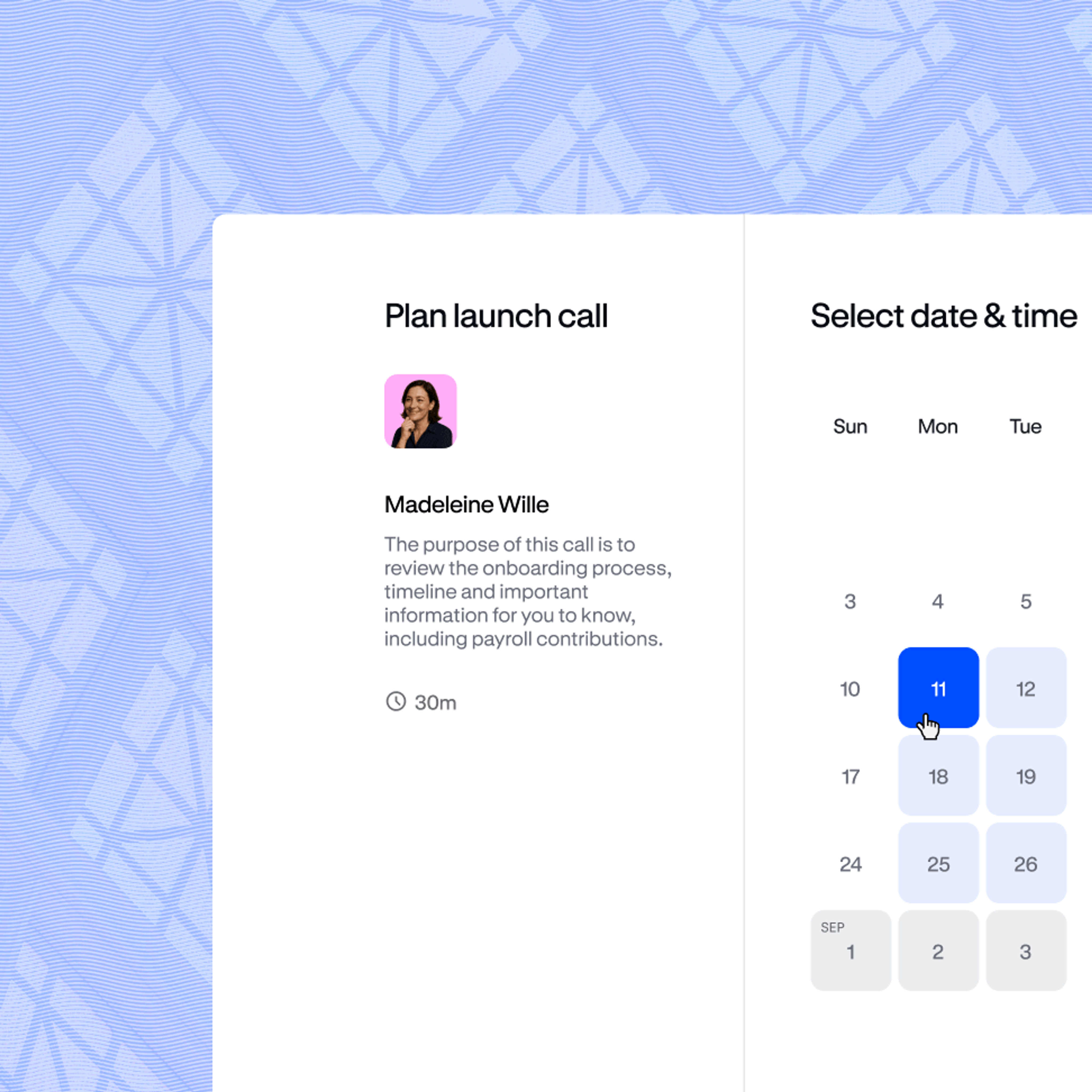

You’re not calling a hotline—you’re backed by real industry specialists who understand your plan and your goals. We’re a partner for your success, ready with hands-on help from day one with a dedicated implementation manager and responsive support team who understand the nuances of mid-sized HR teams.

A full service solution means Vestwell can act as your 3(16) administrative and 3(38) investment fiduciary—helping reduce risk, offload responsibilities, and oversee ongoing plan compliance.

Growing businesses need benefits that keep pace with complexity. Vestwell helps mid-size teams streamline savings programs with flexible solutions, intuitive technology, and hands-on support. Whether you’re expanding your workforce or upgrading from a legacy provider, we make it easier to offer benefits that scale with your team.

Explore how employers set up, manage, and monitor plans in just a few clicks. Everything you need, streamlined in one modern platform.

Select the plan features that align with your company goals and employee demographics. In just a few minutes, we’ll generate your contract, stand up your plan, and handle the rest—getting eligible employees invited and registered on the system.

Connect with leading payroll providers like QuickBooks, Gusto, and Paycor to ensure contributions sync directly. Don’t have a payroll provider? No problem—you can use our intuitive manual contribution flow that keeps everything running smoothly.

Your sponsor portal puts all documentation and plan information at your fingertips—so you can monitor contributions, access reports, and keep everything on track in a single, easy-to-use dashboard.

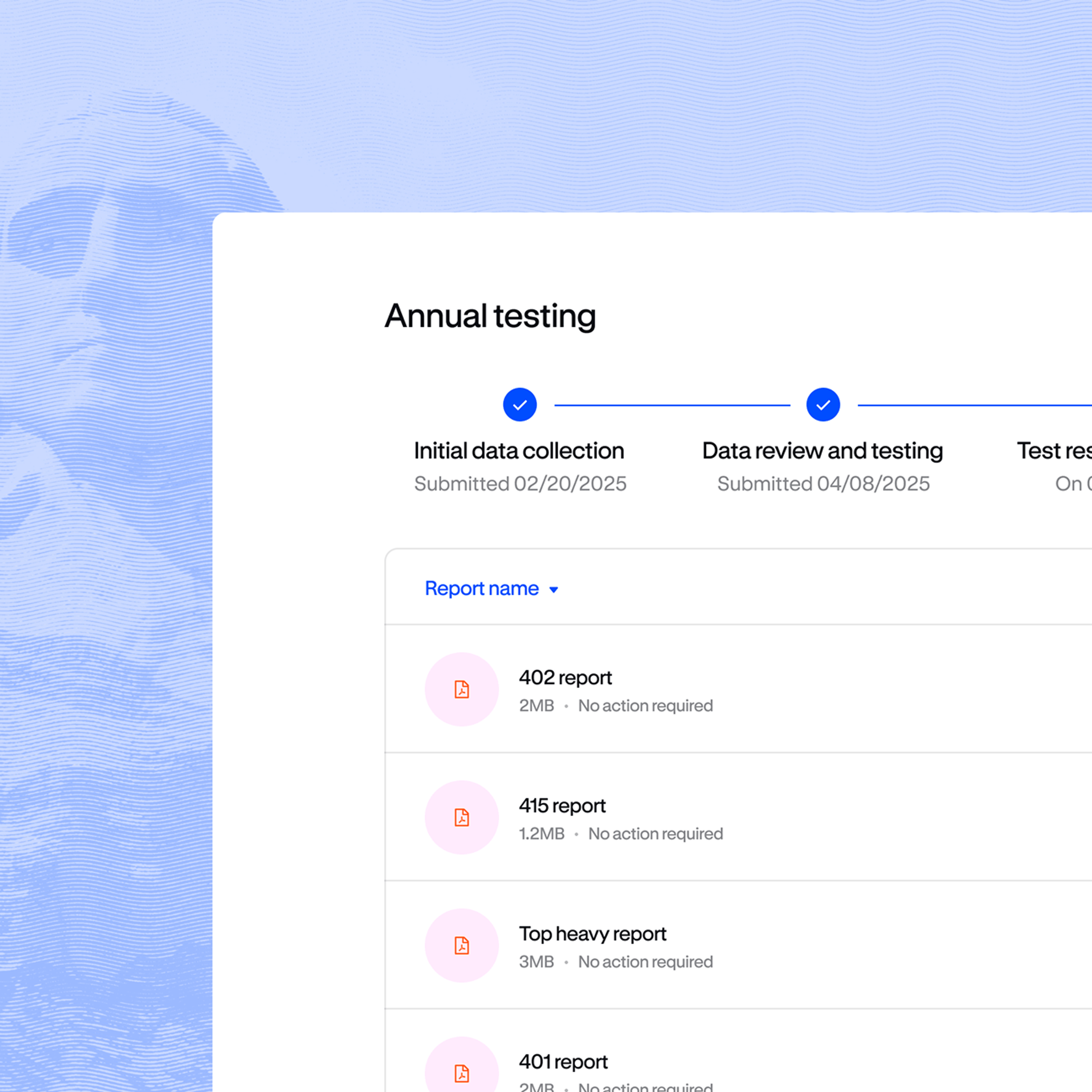

Stay compliant year-round with on-demand plan testing capabilities. Our platform and support team guide you through every requirement, helping you complete year-end obligations with ease.

Whether you're rolling out your first plan or upgrading from a legacy provider, our team is ready to help.

Vestwell connects with over 190 leading payroll providers, including many used by mid-sized businesses. Our integrations streamline contributions, reporting, and ongoing administration so you can run your plan with minimal lift.

Most plans can be set up and running in just a few weeks. Our onboarding process combines digital tools with dedicated support to make implementation simple and efficient.

We provide built-in compliance services, including 3(16) fiduciary support, testing, and filings. This reduces administrative burden and helps you stay aligned with IRS and Department of Labor requirements.

Yes. Vestwell’s platform allows you to bundle retirement plans with emergency savings accounts, so your employees can prepare for both long-term goals and short-term needs—all in one place.

Absolutely. Vestwell offers plan designs and administrative tools that support controlled groups and multi-entity structures. We help you manage complexity while keeping costs and oversight streamlined.

Pricing depends on your plan type and size, but most mid-market businesses pay a base monthly fee plus a per-participant fee. Many employers also qualify for tax credits that can offset setup and administrative costs.